The fraudsters also forward one SMS to you and advise you to forward it to a specific mobile number from your phone. Once granted, the fraudster is now in control of your mobile device.įurther, Mobile Banking credentials and PIN are vished (stolen) from you and the fraudster can now choose to carry out financial transactions from your mobile app which was already installed.

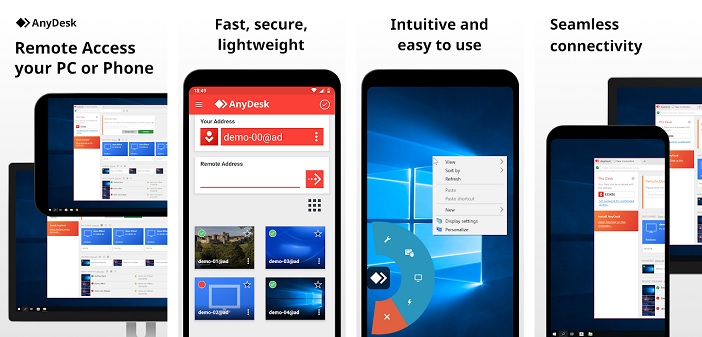

Then the fraudster will further ask you to grant him certain permissions. Post the installation of the app (in this case 'AnyDesk'), a 9-digit code will be generated, which the fraudster will ask you to share.

The fraudster will then lure you to download a mobile app like 'AnyDesk' from Play store or App Store, which can provide him with remote access to your mobile. You may receive a phone call from a fraudster, who will claim to be a representative from a tech company/bank offering to fix issues in your smartphone or mobile banking apps. In personal messages to Union Bank employees, the bank has informed, “Do not download “ANYDESK” from Playstore or any other source, which Fraudster can use to take control of your mobile device and carry out transactions. Anydesk App warning: How fraudsters may lure youĪfter the Reserve Bank of India (RBI) warned banks and customers against the use of AnyDesk App, the Union Bank is also warning its employees about the same.

0 kommentar(er)

0 kommentar(er)